Think back, for a moment, to your pre-Covid-19 life. In those less socially distanced days, fintech was the unsung hero of your Friday night.

You deposited your paycheck by snapping a photo on your smartphone and uploading it using your bank’s mobile app. You checked Mint to gauge your monthly entertainment budget. At dinner, you and your friend split the tab using Venmo. Later, you tapped your phone at the bar to pay for a drink. When it was time to head home, you hopped in an Uber and paid for the ride with a stored credit card—or even in Bitcoin.

Even if you don’t realize it, fintech is likely a big part of your personal and professional day-to-day. Ernst & Young’s latest Global FinTech Adoption Index shows nearly two-thirds (64%) of the world’s population was using fintech applications in 2019, up from 16% in 2015. According to the report, 3 out of 4 consumers had become users of money transfer and payment solutions.

As with many emerging technology sectors, fintech can be an ambiguous concept due to the sheer breadth of tools, platforms and services that fall under its yawning umbrella. If you’re still asking yourself, “Exactly what is fintech?” here’s a breakdown.

What Is Fintech?

Fintech is a portmanteau for “financial technology.” It’s a catch-all term for technology used to augment, streamline, digitize or disrupt traditional financial services.

Fintech refers to software, algorithms and applications for both desktop and mobile. In some cases, it includes hardware, too—like internet-connected piggy banks. Fintech platforms enable run-of-the-mill tasks like depositing checks, moving money between accounts, paying bills or applying for financial aid. They also facilitate technically intricate concepts, including peer-to-peer lending and crypto exchanges.

Businesses rely upon fintech for payment processing, e-commerce transactions, accounting and, more recently, help with government-assistance efforts like the Payroll Protection Program (PPP). In the wake of the Covid-19 pandemic, more and more businesses are turning to fintech to accept contactless payments or adopt other tech-fueled advancements.

What Is Fintech Banking?

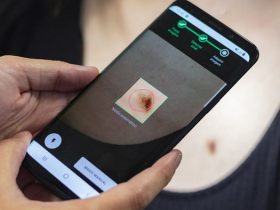

Banks use fintech for back-end processes—behind-the-scenes monitoring of account activity, for instance—and consumer-facing solutions, like the app you use to check your account balance. Banks also use fintech to underwrite loans. Individuals use fintech to access many bank services, including paying for purchases with a smartphone and receiving investing advice on their home computers.

Fintech Companies

The annual Forbes Fintech 50 spotlights the hottest and largest companies in the industry. The 2022 list is topped by Stripe, a decade-old payment processor with a $95 billion valuation. In second place is Klarna, a 16-year-old Swedish firm that offers consumers financing for purchases at many major retailers; it was valued at $46 billion.

Fintech branches off into a number of more granular industries: wealthtech (apps such as Wealthsimple, an online investment management service for Canadians), investtech (like Acorns, which lets users round up purchases to the nearest dollar and invest the difference in a diversified portfolio) and insurtech (such as Next Insurance, a mobile-first carrier). It touches nearly every industry, geographical market and business model.

How Does Fintech Work?

Fintech provides people and businesses with access to traditional financial services in innovative ways that previously weren’t available. For instance, many conventional banks’ mobile apps now offer customers on-the-go access to bank services, including the ability to view your balance, transfer funds or deposit a check. Meanwhile, robo-advisors like Betterment are less costly and more convenient than in-person investment advice from a financial advisor.

Fintech also automates many services businesses use, such as loan underwriting and real estate appraisals. Artificial intelligence combined with massive troves of consumer data helps fintech businesses understand their customers and powers their marketing campaigns, product development and underwriting.

How Has Fintech Evolved?

Just because fintech is buzzy doesn’t mean it’s brand-new. Although Merriam-Webster just added the phrase to its dictionary in 2018, the concept dates back decades. ATMs, for example, were once on the cutting edge of fintech innovation, as were signature-verifying technologies first used by banks in the 1860s.

In recent years, fintech has morphed from being associated with scrappy startups to becoming a significant facet of established and legacy financial institutions. Many major banks are now partnering with fintech companies or launching fintech initiatives of their own. Goldman Sachs, for instance, used fintech to launch an online bank called Marcus in 2016, and JP Morgan Chase invested $25 million in fintech startups in 2019.

Fintech has been proving its value in the face of the Covid-19coronavirus pandemic, even as some of its iterations suffer. Though the Capital One cafes were temporarily closed during lockdowns, banks and credit unions across the U.S. were able to transact—and offer Covid-19 support and services—digitally.

How Does Fintech Affect Me?

The financial services sector isn’t typically synonymous with nimbleness. But today, adaptability and quick iteration (not to mention instant gratification) are precisely what consumers and business owners expect—and, increasingly, need.

Fintech helps expedite processes that once took days, weeks or even months. Fintech also holds the potential to improve financial inclusion: In some parts of the world, where governmental or institutional support is lacking, fintech fills needs for the unbanked.

Part of the reason fintech can streamline traditionally clunky processes is because it’s based on ones and zeros rather than human skills and opinions. While many fintech platforms include elements of both traditional brokers/advisors and algorithms, others help users navigate financially complex tasks without interacting with a human at all.

Today’s consumers can bypass traditional bank branches for things like applying for a loan (LendingClub) or even a mortgage (Better). Casual investors no longer need to meet face-to-face with financial experts to painstakingly go over the ins and outs of their portfolios—they can peruse their options online or even enlist the help of chatbots to make decisions.

To illustrate just how far fintech has brought the financial services world into a Jetsons-style reality, look no further than robo-advisors. These digital platforms provide automated, algorithm-informed investment suggestions and financial planning advice with little-to-no human oversight. One such platform in this arena that made the 2020 Forbes Fintech 50 is Betterment, an advisory firm that proclaims itself “the smart money manager.”

Ultimately, the answer to the question of how fintech affects your life is a case-by-case matter. Outside of tasks like online account monitoring, which has become ingrained into day-to-day banking, the impact of fintech on your life is a personal issue dictated by how many services you choose to interact with. You can go as deep as you want or simply stay surface-level.

Is Fintech Safe?

Engaging with fintechs—many of which remain largely unregulated, particularly in the Wild West realm of cryptocurrencies and blockchain technologies—can lead to unwanted or unexpected threat exposure.

The idea that fintechs adhere to a higher moral standard than the big banks is proving largely illusory. As fintech expert Ron Shevlin points out, banks and customers engaging in “fintech fetishism”—an excessive optimism associated with its early iterations—are now facing a harsh reality check as many promising startups face obstacles both due to and independent of the Covid-19 pandemic.

It’s prudent to approach flashy, yet unproven, fintechs and their lofty promises with a healthy dose of skepticism. As digital data becomes orders of magnitude more extensive and integral to day-to-day life, so, too, do large-scale security snafus. Recent hacks, including high-profile bitcoin heists, have brought these risks to public consciousness.

To date, there’s no consensus on exactly how safe fintech solutions are across the board. Such assurances will likely be difficult to come by, given the scope and scale of fintech proliferation. But consumers are wise to be wary: In the E&Y survey, 71% of fintech adopters agreed with the statement, “I worry about the security of my personal data when dealing with companies online.”

Fintech and New Tech

Of all the technologies that have impacted financial services, the distributed ledger technology that underlies blockchains and makes cryptocurrencies possible is arguably the most significant. But lower-profile emerging technologies may be even bigger influences down the road. Some of the most intriguing include:

- Internet of Things. ATMs that can detect how many customers are in line are a good example of this, as are sensors that enable contactless transactions.

- Augmented reality and virtual reality. Virtual stock trading is one potential use for these still-emerging technologies.

- Smart contracts. Contracts that can automatically execute when certain conditions are met can improve security, increase efficiency and lower the cost of transactions.

- Bots. Also known as robotic process automation, these programs to automate repetitive tasks can free up humans from routine work, enabling them to focus on more valuable activities.

- Voice-enabled payments. Smartphones with voice recognition software let people check balances, transfer money and complete purchases simply by speaking.

Fintech Regulation

No single regulatory body oversees fintech. Some fintechs, in fact, exist largely outside or on the fringes of current regulatory oversight. For the rest, regulation and licensing are overseen by a mix of local, state and federal regulators.

States generally oversee lending, insurance and payment systems. For instance, PayPal must be licensed in every state and follow local payment transmission regulations. However, federal oversight overlaps state regulation, as PayPal is also under the purview of the federal Consumer Financial Protection Bureau.

Additional regulation comes from the Federal Trade Commission, the Securities and Exchange Commission and—for fintechs licensed as banks by the Office of the Comptroller of the Currency—the Federal Deposit Insurance Corp. Fintechs that partner with banks often have to follow the same rules as their partners, so depending on the type of bank, they may be indirectly regulated by federal, state and local authorities.

The question of how fintechs will be overseen is a major topic among financial regulation circles. This is a rapidly evolving area as the regulatory rule-makers attempt to keep up with the fintech innovators.

What Does Fintech Hold for the Future?

Nobody knows for sure what fintech innovations are on the horizon, and this uncertainty has been worsened by the chaos caused by the pandemic. Fintechs, like their customers, have suffered financial setbacks—some have had to downsize or furlough staff, and others are struggling to secure investor funding. At the same time, demand for fintech has perhaps never been higher: Businesses and banking customers increasingly rely on technology to help navigate their financial livelihoods.

Despite the current economic uncertainty, larger and long-term trends for the future of fintech remain relatively intact. Consolidation, partnerships and continued collaborations between legacy banks and fintechs seem imminent. And consumers can probably expect to see the continued emergence of companies touting shiny, headline-worthy services, including the likes of blockchain, cryptocurrency, artificial intelligence and peer-to-peer transactions.

©️Forbes

Leave a Reply