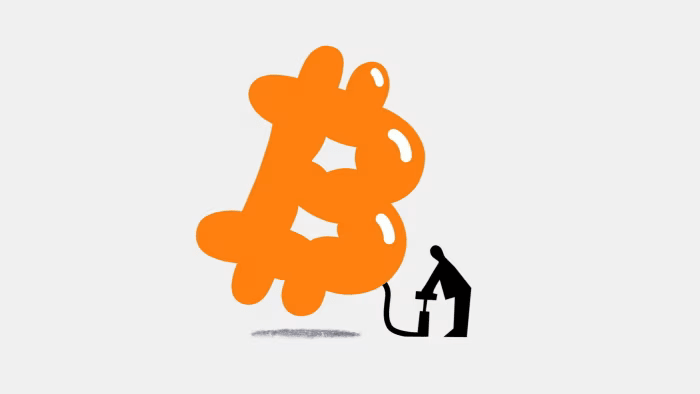

In case you hadn’t haven’t (or choose to ignore such things), bitcoin is back. The original — and still biggest — cryptocurrency surged to a record high of more than $72,000 on Monday, having more than tripled in value in the space of a year. Other crypto tokens, such as ethereum and dogecoin — beloved by Elon Musk — have also been rallying, with the estimated value of the market climbing to above $2.7tn for the first time in more than two years.

The funny thing is, though, that there’s a chance you have actually not heard. There’s not so much talk about which token is next going “to da moon” or so many instances of “Wen Lambo?” this time around. Newspapers aren’t running stories about how hilariously rich everyone is getting apart from you. Worldwide search traffic for “bitcoin” and “crypto” has climbed in recent days but it is still only about half the level it was the last time a record was hit in 2021, according to Google Trends.

No, crypto in 2024 (so far, at least) is a rather more subdued affair. And the reason is that the factors reckoned to be driving rising prices are far from the kind of wild crazes we’ve seen before, such as the mania for initial coin offerings in 2017 or for non-fungible tokens in 2021.

Instead, there are some rather more prosaic things going on. These are: supply and demand dynamics in the lead-up to the “halving” expected in April, when the number of new bitcoins mined every 10 minutes halves to 3.125; the prospect of lower interest rates; and institutional capital flows into the 11 bitcoin-based exchange traded funds approved by the US Securities and Exchange Commission this year.

The last factor is probably having the most impact. More than $50bn has been cumulatively traded in bitcoin ETFs, according to data from crypto platform The Block, with the one launched by BlackRock, the world’s biggest asset manager, already the firm’s third-biggest exchange-traded product and the fastest ETF ever to reach $10bn. Some of the world’s biggest banks — Morgan Stanley, Wells Fargo and Bank of America — are all reportedly lining up to get involved in bitcoin, too. (The painful lessons of the financial crisis, about avoiding high-risk, toxic assets, have been forgotten, it seems.)

The buyers using these new ETFs are conventional investors who see it as a way of diversifying, rather than true believers. So you might think bitcoiners would be unimpressed by their anarchic cryptocurrency — whose raison d’être is, it seems, to circumvent such middlemen and provide a decentralised, censorship-resistant form of money — being overtaken by the world of traditional finance. Bitcoin has always been about sticking it to the man, surely, not making rich banker-men richer.

But you would be wrong. “The OTC desks are running out of $BTC. This is why we are pumping so hard. Institutional FOMO is starting now, $100k will come very soon,” posted one much-followed crypto account on X. “I’ve become pro-ETF, because . . . anyone who’s got some kind of exposure is now incentivised to be Team Bitcoin,” said Peter McCormack recently on his What Bitcoin Did podcast. “Let’s just say it’s good to have [BlackRock CEO] Larry Fink on your side. This is the great thing about bitcoin — all our incentives align.”

He’s right, of course: when something is backed only by belief, you want as many believers as you can get. But this does rather give the game away about what motivates people to be on “Team Bitcoin”.

The institutional investors entering the market do not believe bitcoin is the future of money, nor that it will revolutionise and overthrow the financial system; these companies are the financial system. They buy bitcoin because they calculate they can eke out extra returns by doing so. Furthermore, Fink is not really Team Bitcoin at all — he has said he also “see[s] value” in an ethereum ETF.

The reality is that the embrace of crypto by the world of traditional finance, or “TradFi”, as crypto types like to call it, is just as hypocritical as crypto’s embrace of institutional investors. I heard one of the hosts of another bitcoin-focused podcast, the Wolf of All Streets, say recently that “TradFi is just as degen” — a crypto word describing a reckless (and degenerate) gambler — “as the crypto community is” and this, unfortunately, is not wholly unjustified.

With the advent of bitcoin ETFs, what was once a relatively clear boundary between crypto and conventional finance has been broken down for good. And the world of TradFi has shown the emptiness of its talk of learning the lessons of the financial crisis. It has shown that — like the world of crypto — it is really just as greedy as ever.

©️FinancialTime

Leave a Reply